Better Opportunities for New India post COVID 19 : The World Manufacturing Hub

The whole world is struggling hard with the global lockdown during the pandemic COVID-19 and is striving its best to regain its economies. The IMF World Economic Outlook came out with its interesting growth projections stating that the Euro Area is projected to have a de-growth in 2020 at minus 7.5% and projected growth of 4.7% in 2021. They have projected that India will have a better position by attaining 1.9% in 2020 and 7.4% in 2021 as against a contraction in the global economy. India has great opportunity to become a global manufacturing hub and to boost their MSME sector which is the lifeline of the country which eventually contributes 45% of the total manufacturing and 40% of the total exports and provides huge employment to all the skilled, semiskilled and unskilled youth of the country.

The pandemic COVID-19 had its origin in China and it has gradually spread its claws all over the world creating global economic destruction and resulting in Anti-Chinese sentiments in the system. Now businesses and manufacturers are looking for possible alternative locations to set up their manufacturing units. Various companies are planning to shift its manufacturing units from China to India, Vietnam, Thailand, Indonesia, Eastern Europe etc. India is being seen as a viable option to become a global manufacturing destination going forward. Countries like Japan are in talk with the Indian Government to set up their base in India. Market giants like Pegatron Corp., Google, Microsoft, Apple’s manufacturing partner Wistron Corporation are planning to move out of China and set up their manufacturing units in countries like India, Vietnam, Thailand, Indonesia etc. India is one of the good choices for these companies due to its young population, availability of abundant land, skilled labour, low tax rate for new manufacturing units and favorable business environment. As per the World Bank latest 2019 data, in ease of doing business, Thailand ranks at 21, followed by India at 63, Vietnam at 70 and Indonesia at 73. But is this all that is needed?

The entire world now is rethinking to develop their manufacturing niche in their own country or set up their manufacturing unit in any other country except China so as to avoid such devastating loss in the future. This is a brilliant opportunity for India to become the manufacturing hub of the world by pressing the reboot key to start afresh with new ideas and new goals in New India. Hence, it is important to justify why the businesses will shift to India and not to the other countries. Developing India as a manufacturing hub and an economic powerhouse is not like pressing the F5 key on the computer. Not only we have to attract the foreign companies to set up their manufacturing units in India, but also rejuvenate our MSME sector to grow and support our economy and the international manufacturing in India.

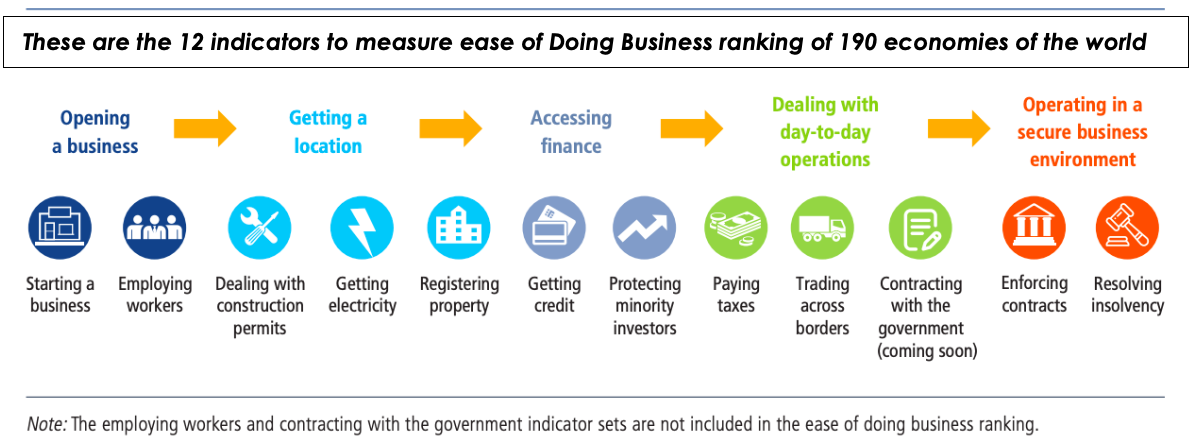

Let us now analyze whether doing business in India is really easy as compared to other nations. As per the World Bank study, there are majorly 12 indicators, whose aggregate score, giving equal weight to each indicator, determines the rankings of the countries in ease of doing business and they keep on changing on year to year basis.

*Source: The World Bank

India is one among the top 10 countries which has shown major improvement in 2019 vis-à-vis 2018. After climbing up the ladder, due to business-friendly policies of Modi Government, India is now at 63rd position out of 190 countries with DB Score of 71.0 out of 100 points. These are the 10 indicators of ease of doing business which is prepared by comparing the business regulation in 190 countries and are being considered by the businesses (domestic and international) before starting a new venture:

| Sl. No | Indicators | India | Way forward for better ranking by India |

| 1 | Starting a Business

This topic measures the number of procedures, time, cost and paid-in minimum capital requirement for a small- to medium-size business to start up and formally operate in each economy’s largest business city. |

136 | 136 out of 190 is not a good score, we need to at least reach a score within 50 as far as starting a business is concerned. Norms for starting a new business needs to be relaxed and should be made online in time bound manner. Due to the federal structure and the nature of businesses, they has to take several permissions from the Central and State Governments. Thus, a close coordination should be there between both the governments. Though the Ministry of Corporate Affairs has already implemented various steps like reduction of fees for incorporation of Company, introduction of SPICe, formation of a Company in 1 day, relaxation in the minimum paid-up capital requirement for ease of doing business, but we have to review various other compliances applicable for starting a new business and try to reduce the number of procedures, time and cost of the entire process. |

| 2 |

Dealing with Construction Permits It tracks the procedures, time and cost for obtaining the necessary licenses and permits, submitting all required notifications, requesting and receiving all necessary inspections and obtaining all requisite connections and permissions. |

27 | India was at the 52nd position in 2018 as against 27th in 2019. Although India has streamlined the process and improved its quality building controls, with faster and less expensive procedures to get construction permits in Delhi and Mumbai, but for better ranks it is advisable to encourage digitalisation and online approval for easy operation by each of the State Governments. For a better ranking post lockdown, India should now reduce/ minimise the number of procedures for getting the construction permits along with the time and cost of the process and build more effective quality control parameters. |

| 3 |

Getting Electricity This indicates procedures, time and cost required for a business to obtain a permanent electricity connection. |

22 | Though we have reached a score of 22 out of 190, but we need to improve the score further. Automated mechanism needs to be set up for supply of electricity connection. Further, more solar and hydro power plants, transmission lines needs to be set up all across the country so that there is no scarcity of supply of electricity. Our country needs to focus on reducing the time, cost and number of procedures for getting the electricity connections and emphasise on reliability of supply and transparency of tariff. |

| 4 |

Registering Property This is one of the primary steps for any new business to set up. It examines the steps, time, and cost involved in registering an undisputed property i.e. land and/ land along with building. |

154 | We are at 154th position out of 190 countries, hence we need significant improvement in getting property registered in the name of businesses because owning a land/ property for businesses is one of the most important and critical steps in setting up a new business, wherein there are some improvements. The Government needs to rationalise the land acquisition law and standardise online system of allotment of land by the industrial development authorities. It is also required to work on increasing the quality of land and administration process along with better transparency and reduce/ minimise the time taken, cost and number of procedures. |

| 5 |

Getting Credit This topic covers two aspects of access to finance—the strength of credit reporting systems and the effectiveness of collateral and bankruptcy laws in facilitating lending. |

25 | The entire process of getting credit in India needs to be reviewed, relaxed, standardised and made online. The Government needs to strengthen the legal rights of all the parties in the contract as well as transparency in assessing the credit score and expand the scope of information collection and reported by credit bureau. |

| 6 |

Protecting Minority Investors It measures the strength of minority shareholder protections against misuse of corporate assets by directors for their personal gain as well as shareholder rights, governance safeguards and corporate transparency requirements that reduce the risk of abuse. |

13 | The interests of the minority investors needs to be protected more strictly. Disclosures needs to clearly explain the facts, terms and risks involved, extent of directors’ liability and shareholders rights should be highlighted. Policies for corporate transparency, ownership and control measures needs to be reviewed and rationalised. |

| 7 |

Paying Taxes It records the taxes and mandatory contributions that a medium-size company must pay or withhold in a given year, as well as the administrative burden of paying taxes and contributions. |

115 | India has a rank of 115 out of 190, which shows that the Government needs to review its taxation policies and significantly work on getting a better score within top 50. The Government needs to encourage businesses and individuals to pay tax and rationalise their compliances and administrative burden of collection should be bare minimum. They need to work on increasing total tax and contributions received and reduce the tax rates. Computation, compliance, filing and refund of direct and indirect taxes should be made easy. The taxation system needs to be made uniform so that the taxpayers find it easy and just, to pay the taxes and the tax audit processes needs to be reviewed along with rationalising labour taxes and other mandatory contribution (other than tax on profit). |

| 8 | Trading across Borders

Doing Business records the time and cost associated with the logistical process of exporting and importing goods. It measures the time and cost (excluding tariffs) associated with three sets of procedures—documentary compliance, border compliance and domestic transport—within the overall process of exporting or importing a shipment of goods. |

68 | India has implemented post clearance audits, integrating trade stakeholders in a single electronic platform, upgrading port infrastructures and enhancing electronic submission of documents in Delhi and Mumbai. The Government should now relax the existing laws regulating trade relations between India and other countries except the countries sharing land borders with India. While exporting or importing we have to reduce the time and cost for documentary compliance and border compliance. |

| 9 |

Enforcing Contracts It measures the time and cost for resolving a commercial dispute through a local first-instance court, and the quality of judicial processes index, evaluating whether each economy has adopted a series of good practices that promote quality and efficiency in the court system. |

163 | Since India now ranks at 163rd position out of 190 countries as per the World Bank data, the Government needs to stress on putting extra efforts in its system to enforce contracts. India Government should now bring out effective steps to resolve commercial disputes and enforce contracts. The Government should reduce the time to enforce contracts i.e. from the date of filing of dispute till the date of passing the order at the first-instance court with a minimum cost and increase the quality of judicial processes. |

| 10 |

Resolving Insolvency These variables are used to calculate the recovery rate, which is recorded as cents on the dollar recovered by secured creditors through reorganization, liquidation or debt enforcement (foreclosure or receivership) proceedings. |

52 | After the Insolvency laws, India has made resolving insolvency in a much easier way by promoting existing reorganisation proceedings. Government now needs to work on the effective implementation of the law in line with the international laws. Focus needs to be also drawn in increasing the recovery rate and strengthening the insolvency framework. |

| 11 |

Employing workers Labour laws to avoid worker exploitation, discrimination of hiring and working policies and unfair dismissal practices vis-à-vis rational and flexible labour laws for the growth of business |

Not considered in ranking in 2019 | The employing workers indicator measures regulation in the areas of hiring, working hours, and redundancy. A country should have flexible labour regulations, which provides workers an opportunity to choose their jobs and work freely, thereby increasing the labour productivity. India should have easy hiring framework with flexible rules so as to reduce the rate of unemployment among youth and female workers. |

| 12 |

Contracting with the Government Efficiency in public procurement policy to ensure better use of taxpayer’s money |

Not considered in ranking in 2019 | The contracting with the government indicator captures the time and procedures to win a public procurement contract. The Indian Government should review and take effective steps to prepare a database which constitutes a repository of comparable data on how efficiently public procurement processes are carried out and which will act as a benchmark to analyze efficiency of the entire public procurement life cycle. The procurement process should be an open unrestricted and competitive public call. |

We have seen that since the past few years, India is significantly improving its position in ease of doing business as per the World Bank ranking. Apart from ease of doing, the country has to take some bold steps to come out of COVID-19 setback and achieve its dream of becoming the most attractive manufacturing hub and in establishing new businesses.

a) The biggest challenge for us is to create a lucrative environment for the international businesses by relaxing the compliance procedures followed in the country. The Government shall start easing the punitive and criminality clauses from compliance, business, commercial and labour laws and trusting the businesses so that the investors/businesses can concentrate more on the growth of their business, rather than wasting time on the compliance burdens. Government should rely on the self-declarations being given by the businesses and give them a more work friendly environment. Maximum companies prior to investing in India will compare the entry procedures i.e. starting a business in India, getting lands, enforcing contracts, statutory compliances, penalty and prosecution clauses in compliance, business and labour laws with that prevailing in other countries. The India Government is now focusing on interacting with the businesses and stakeholders of various other countries to set up their manufacturing base in India but the Central and State Governments may set up specific workforce for interacting with the foreign and Indian entrepreneurs and frame guidelines for timely completion of the projects. The said workforce may be formed jointly by the industry experts, professionals and Government representatives;

b) As a matter of continuous endeavor of the Government to promote MSME, enough safeguards are already built in the MSME law which states that for every services/goods supplied by the MSME unit, the buyer needs to make payment as per the pre-set terms but not exceeding 45 days and in case of delay, interest is charged. The Government needs to implement this law strictly and ensure that the dues from the State/ Central Government, PSUs and big corporates are paid to the MSMEs immediately along with the applicable interest. As per the law, MSME registration is very simple through Udyog Aadhaar (https://www.msmeregistration.org), however still a lot of MSMEs are unregistered and not able to get all the benefits allowed to registered MSMEs. The Government needs to ensure that all the MSMEs get themselves registered through the website. The State Governments should also relax or defer the labour law applicability on MSME sector for few years;

c) The Reserve Bank of India (RBI) needs to pump in more funds in the system to fund the MSME sector. The total liquidity injected in the market by RBI values 3.2% of the GDP, which the Government needs to ensure that it flows into the MSME sector. In order to fight the financial crisis caused by the COVID-19, the MSME sector may be granted a moratorium period of 6 months instead of 3 months and immediate fresh business loan may be granted to those MSMEs who do not have any existing loan. The cash flows of the MSMEs may be maintained by enhancing the overdraft limit to 25% without any primary security or otherwise, with repayment schedule starting after 6 months from the date of granting the facility. Further, the Government should strictly implement the ‘Credit Guarantee Fund Scheme’ to make available collateral-free credit upto Rs 2 crore to the micro and small enterprise sector. The Government should also ensure that the banks approve the loan to the MSMEs and the purpose of bringing this scheme doesn’t get defeated. The Government should also relax the norms pertaining to non-performing assets of the MSMEs to release the burden from their shoulders. They should further assure the banks/ financial institutions that in case any loan turns bad in future, the sanctioning authority will not be held liable and they will not be booked by the criminal law;

d) The State Governments has to promote MSMEs in manufacturing and service sectors in B-class, C-class, small towns and villages and link them with digital platforms for procuring raw materials and selling their goods. Though we have a few digital platforms for selling of goods in MSME sector which are run by the Government, but we need such digital platforms which will be run and managed by the MSMEs only and which can be operated in the local language also for easy understanding by the MSMEs.

e) The country’s agriculture sector accounts for 17% contribution in the GDP and has a growth rate of 2.1%. Out of the 138 cr population, approx. 58% population of the country is engaged in the agriculture sector. Since agriculture sector is the prime sector employing the maximum population of India, the Government needs to focus on increasing the percentage of the contribution to GDP from this sector by allowing businesses to invest in this sector by way of PPP model. Accordingly, the businesses can invest at the initial stages i.e. funding the farmer for seeds, fertilizer, labour cost etc. and purchase the entire crop at a price not which is being fixed by the Government. In case of any natural calamity or unforeseen circumstances resulting in loss of crop, the farmers and businesses should get the minimum fixed amount from the insurance company. The businesses may adopt this as their business model. Currently the Government through banks, provides loans to the farmers and if due to some natural calamity or otherwise, the crops get affected, then as a result of various compulsions, the Government has to waive off the loans and it creates a habit of financial indiscipline in the country.

Conclusion:

In this global crisis, each and every country is trying to start afresh and revive back its economic growth and become the new economic powerhouse. The Indian Government has always been reviewing its policies in the best interest of the country. The focus should now be drawn on improving India’s performance in ease of doing business by reviewing and rationalizing its policies in Dealing with Construction Permits, Getting Electricity, Registering Property, Paying Taxes, Trading across Borders, Enforcing Contracts, Resolving Insolvency, Employing Workers and Contracting with the Government. The existing punitive and criminality clauses from compliance, business, commercial and labour laws need to be reviewed and relaxed. Entrepreneurs and foreign businesses should be given a free hand to focus on the business growth and in turn aid in the economic growth of the country.

MSME sector is growing at 10%, which needs to be escalated by establishing MSME in small town and villages and connect them through digital platforms owned and run by the MSME sector in the local language also. The State Governments should relax or defer the labour law applicability on MSME sector and incentivise them link with their production for the next few years. The Government should strictly implement the ‘Credit Guarantee Fund Scheme’ to make available collateral-free credit upto Rs 2 crore to the MSME sector. They should also ensure that the banks approve the loan to the MSMEs and the purpose of bringing this scheme doesn’t get defeated. The Government shall also focus on developing the agricultural sector by allowing investment through farmer-business-government model where Government needs to allow investment by businesses and the minimum price should be controlled by the Government.

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

0 Comments